On this second question. Its true that investors are under utilized and strangely in private impact investing that may be even more of a problem then in purely for profit VC style investing that has investor participation built into the model. Ironically because there is a higher trust between impact investors and private impact companies there can be less interaction where the resources of the investor could help the investee. This may sound strange but because there is more trust their can be less questioning which leads to fewer opportunities to engage. Investors in privates should consider taking board seats and using their skills to help, more like in the VC model.

Agreed, I think they can also use good questions to stimulate constructive reactions from the business. Such as ‘what are your material positive and negative social and environmental impacts across the value chain?’ ‘What risks and opportunities do global trends present to the business and its value proposition?’

My name is Myriam Sidibe, one of the world’s leading experts of brands that drive health outcomes through mass behavioural change. From within Unilever, I have created a movement to change the handwashing behaviours of one billion people, the single biggest hygiene behavior change programme in the world, and conceived and established the multi awards winner UN recognized Global Handwashing Day – now celebrated in over 100 countries.

I have worked for the public sector and the private sector, arguing for a more transparent relationship between the for-profit and not-for-profit sectors, advocating the need for businesses to gain growth and profits from engagement in social and health issues in order to build more sustainable, effective interventions.

I am currently on sabbatical from Unilever to Harvard Kennedy School where she is a senior fellow at the Mossavar-Rahmani Center for Business and Government. I am the author of the book Brands on a Mission : How to Achieve Social Impact and Business Growth through Purpose (Routledge 2020) and my TED talk The Simple Power of Handwashing has been viewed more than 1 million times.

Yes definitely. I think that it’s good to ask these questions that (i) scratch below the surface but also (ii) address how companies deal with these issues in a systematic manner (as opposed to a few specific examples or case studies).

Transforming disclosure is something that companies and investors could definitely do together. The WBCSD’s Purpose-Driven Disclosure (PDD) project is a great example of this. It focuses on improving externally reported company information in order to enable better decision-making and outcomes for companies and investors.

A2: Institutional Investors can influence large companies by rewarding those with progressive approaches to purpose-led or inclusive business practices, and by divesting from companies that do not follow industry best practices. Blackrock has been a leader in highlighting its position in issues of climate change and purpose, and has the potential to have a major influence on companies where it is a major shareholder, but it has not been particularly aggressive about divesting or shifting its investment strategy around social impact, purpose, or negative impacts on people and the planet. Fingers crossed they can drive influence in other ways.

nice to see you here Vitto.

Agree with Jon, in private markets investors exert influence through investment terms, board oversight, and the release of follow-on funding. A good framework for the role that investors play is here - page 11. https://impactmanagementproject.com/wp-content/uploads/Snowball_vf-1.pdfinvestors . There is also research on how term sheets can be adapted to be more impact-friendly - actually Toniic has a project around this! https://www.impactterms.org/

Likewise Myriam! and looking forward to reading your book

Thanks Rares, I work on that project, especially the content on alternative investment finance structure so I appreciate the mention, Sharing best practices is one of the ways investors can help grow the space.

I agree BlackRock has been really good to push its companies.Many brands have come round to the idea of having a purpose. The Business Roundtable recently issued a “Statement on the Purpose of a Corporation,” signed by the CEOs of 181 of the largest US corporations. It concluded: “Each of our stakeholders is essential. We commit to deliver value to all of them, for the future success of our companies, our communities and our country.”

This represents a clear move from shareholders to stakeholders, ranging from employees to communities in which they operate. BlackRock’s Larry Fink recently told the companies in which he invests that “profits are in no way inconsistent with purpose – in fact, profits and purpose are inextricably linked.”

With some corporations becoming larger than nation states, we need a new model of enlightened capitalism. How do we link real business models with allevi-ating real suffering, and what can brands and marketing do to help?

Clear oversight and ownership that evidences board accountability, understanding and command of the subject matter or Statement of Purpose and incentivisation to deliver on the purpose sends a clear message to stakeholders and shareholders

On purpose and accountability, I’ve been pleased to see Unilever show transparency around where they achieved the USLP goals, and where they fell short. They seem comitted to sharing what they’ve learned, both from their successes and their failures. That’s not something I see often, and is so important to accelerate progress.

Very good point. I am very concerned about how you translated the business roundtable commitment to reality. hence the essence of my book Brands on a Mission: How to achieve social impact and business growth through purpose. The idea is to give a real framework on how to do it and how to keep companies and brands accountable?

What we hear from many companies in our engagement is that only a minority of their investor base is asking these questions (in many cases less than 10%). Until these asks become more mainstream, the pressure to change and embed purpose authentically won’t be big enough for companies beyond the ‘usual suspects’ that are already doing good work.

Agreed, but I think the return to stakeholder capitalism doesnt go far enough. It also needs to bring in environmental and social limits, otherwise the risk is stakeholder interests will be insufficiently represented. This is an especial challenge and opportunity for brands that need to take a holisitc approach and not just focus on the brans itself- but also its supply chain impacts and use and disposal phase to be credible and genuinely impactful.

https://www.ft.com/content/7a945219-bd89-450d-9ec8-fdeb8ba3a0da

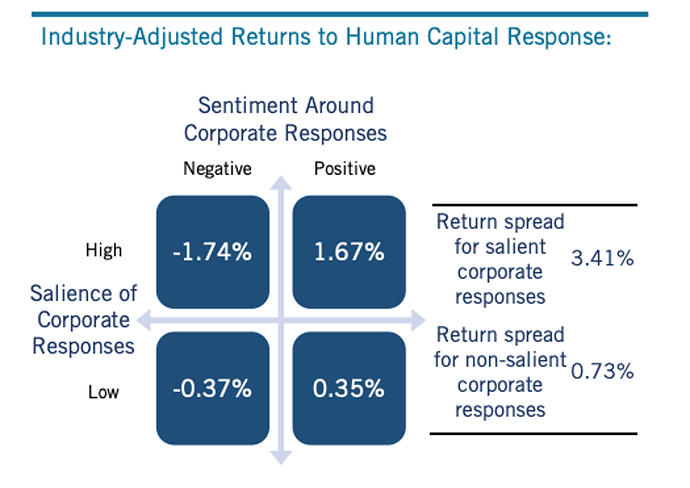

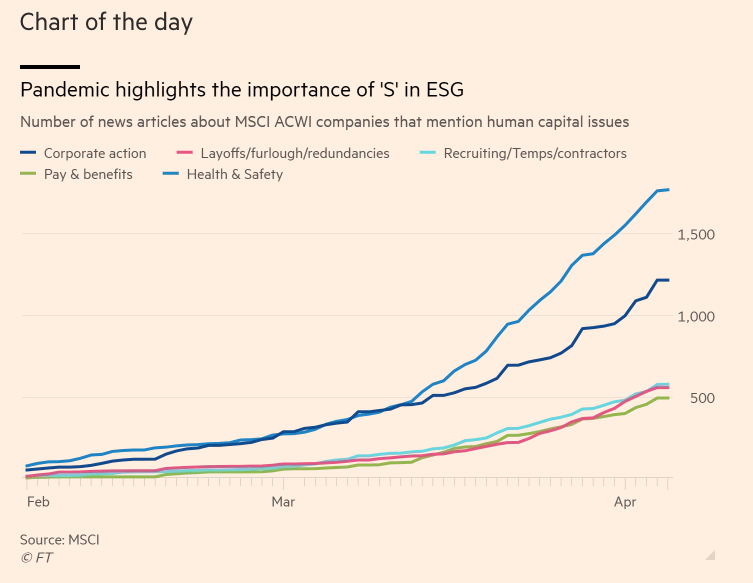

COVID has been an important catalyst for investor behaviour in the public markets too. Companies’ responses has been tracked by the media and this has an impact on investor behaviour too.

[chart is from May 8]

Our third and final question today:

Q3. What are your best examples of how companies and investors collaborate to embed purpose authentically into business? Our research suggests that there could be three areas in which collaboration between investors and companies would be particularly fruitful: Materiality, Leadership, and Impact - what could this mean in reality?

Researchers found strong evidence to show institutional investors actively sought to put money into companies that received positive press coverage for their “human capital, supply chain, and operational response to Covid-19.”Source: State Street

A3: I’d point to ‘Climate Action 100+’, a coalition of investors managing $35 trillion in assets, and their work speaking to high carbon sectors like oil and gas, mining and transport and achieving incredible climate commitments.

While experts say the commitments must go further than they are & evolve the point is that investors & companies can come together to speed up the journey of embedding purpose. Even when it seems to fundamentally conflict with the core product or service.

This should make us all optimistic about what is possible. Particularly on issues that don’t conflict with a company’s means of profit-making.

A culture of investors intentionally pushing for purpose and seeking to have a positive impact on people and the planet is rare to see. Financial materiality and still trumps positive impact.

Many ESG and sustainability professionals working in banking and fund management are still told to ‘care in their own time’ and that things like environmental breakdown aren’t their problem. We need to get past that and I don’t know what the answer is….government intervention on clarifying the social purpose of finance?